You’ve likely heard about implementing advanced analytics in the banking industry: As a collection of strategies, technologies and measurements, it can help you analyze vast swaths of data.

This guide will help you to understand just what banking analytics is, and how it applies to your operations. It will give you useful definitions. It will describe the numerous advantages and unique benefits that advanced analytics implementation brings to the banking industry. It will show you how to derive operational benefits from analytics in banking.

It will discuss key performance indicators or KPIs, and give you useful banking examples. It will include a real-life case study, and discuss the importance of clean data for your banking operational improvement efforts. It will cover dashboards, data repositories, and lots more.

Table of Contents

- Defining analytics in banking

- Role of banking analytics

- Three top benefits banking analytics

- Four key steps to maximize the benefits of banking analytics

- Applying banking analytics to improve operations

- Identifying areas to improve when implementing analytics in banking

- Analytics dashboards and data visualization in banking

- The importance of KPIs in banking analytics

- Example KPIs

- A case study in retail banking analytics

- The importance of standardizing banking data

- How to configure a banking analytics data repository

- How banking analytics helps with process standardization

Defining banking analytics

To understand analytics in banking, it’s best to begin with a broader definition of analytics itself. And so “banking analytics” is used to describe all the different strategies, data management methods, and technologies which businesses use to analyze banking data for business information. It’s thus employed for:

- Operations reporting

- Data mining

- Business performance management

- Benchmarking

- Predictive analytics

Banking analytics, then, refers to the spectrum of tools available to handle large amounts of data to identify, develop, and create new business strategies.

(And while having data is certainly a prerequisite to the process, it’s just the start. Messy or unstandardized data won’t work; even the best banking business analytics software can’t overcome such limitations. We will discuss this in greater detail shortly.)

The role of analytics in banking

Properly implemented, analytics in banking gives banks the ability to harness heavy-duty analytical concepts, slice-and-dice data, and do all of the above on an unprecedented scale. That’s because these systems can wrangle data from a nearly limitless number of sources. It then allows banks to visualize the information it crunches, making hard-to-spot patterns readily apparent via ingenious reporting.

This, in turn, can help banks with operational improvement, cost-cutting, and a transformative customer experience. With analytics-empowered data, banks can transform from the front line all the way up the enterprise. They can make life better for internal and external customers alike, all while boosting the bottom line.

Three top benefits of analytics in banking

With big data properly wrangled, cleaned, and modelled, analytics in banking yields three key benefits. It allows banks to:

- Peer deeper into the customer experience. When you enable deep analytics in banking, you can gain a multi-layered look at the customer experience. You can drill down to things like individual transaction histories, providing eye-opening insights. You’ll be able to see, from a data-enabled viewpoint, what the customers see—good and bad—about your bank.

- Improve employee performance—continually. Why rely on annual reviews or one-time reports? One of the key benefits of analytics in banking is the ability to drill down deep—to the performance level of individual employees—and how that varies by function, branch, or region. This becomes a powerful tool.

- Drive end-to-end improvement. While analytics in banking allows you to drill down, it also lets you zoom out. This allows you to see the enterprise at a glance, and put cross-functional banking KPIs to work.

Four key steps to maximize the benefits of banking analytics

Today’s banks struggle with their data. They’ll throw Excel sheet after Excel sheet at the problem, attempting to report as much as they can. But that approach is misguided. In order to ensure that you derive the greatest possible benefit from analytics in banking, it’s best to follow these four steps:

- Perform a metadata analysis of your existing banking data, to make sure it’s tagged in a useful way. (This is also known as data categorization).

- Incorporate automation into your data capture as much as possible. This removes spreadsheets, reporting layers, and pushes newfound metatags into the underlying data systems.

- Make contingency plans. Think about what it would mean for your banking analytics if a data stream should go down. Have plans in place for that possibility.

- Clearly document data maps—including where the data comes from and what KPIs (key performance indicators) it feeds in to your banking analytics

As noted above, the best way for analytics in banking to work is for the data upon which the entire process hinges to be as clean and standardized as possible. Once it’s clean, then your analytics software can do what it does best:

- Analyze that data.

- Develop queries to check against said data.

- Create reports with analytical results, including dashboards and other forms of data visualization.

Applying banking analytics to improve operations

Banking analytics is instrumental in improving operational efficiency. This is due to multiple factors that a banking analytics project can help bring to light. Consider some of these commonly-posed questions, which deep data insights from analytics can help to address:

- Are there any inefficiencies in our bank’s current operations?

- Which of our bank’s services and products are most and least profitable?

- How can we more easily identify, and therefore work to retain, our most profitable customers?

- Can we target our bank’s marketing campaigns better if we segment our customer base? If so, how?

Banking analytics is used to generate a series of reports and dashboards that will offer you a clearer picture of your current operations. From there, it’s a matter of taking that knowledge and applying it in the real world. Thankfully, key performance indicators (KPIs) make this easier to do.

Identifying areas to improve when implementing analytics in banking

No process can be meaningfully improved without first knowing how it stacks up. Fortunately, that’s built into analytics in banking: It can help to identify areas that are ripe for improvement.

Many banks discover that the first thing they need to improve is the very data that they possess. Banking analytics—and specifically business intelligence software in the banking industry—relies on data gleaned from a multitude of internal sources.

Unfortunately, that data is almost always messy and thus unsuitable for use in business-intelligence projects. To begin your analytics in banking initiative, you must seek out specially trained and qualified staff that can clean that data efficiently. Otherwise, you might devote some 80 percent of project time to that task.

This may sound simple if you happen to already be familiar with analytics in banking; however, even experienced analytics companies can get tripped up by this. That’s because the data which these companies’ business and IT departments are working with is obtained in a relative vacuum: They lack sufficient experience with banking operations to get a handle on the most important data to consider that impact the business lines. While that’s certainly not the fault of these professionals, it presents an opportunity for growth and improvement that could lead to the true benefits of analytics in banking.

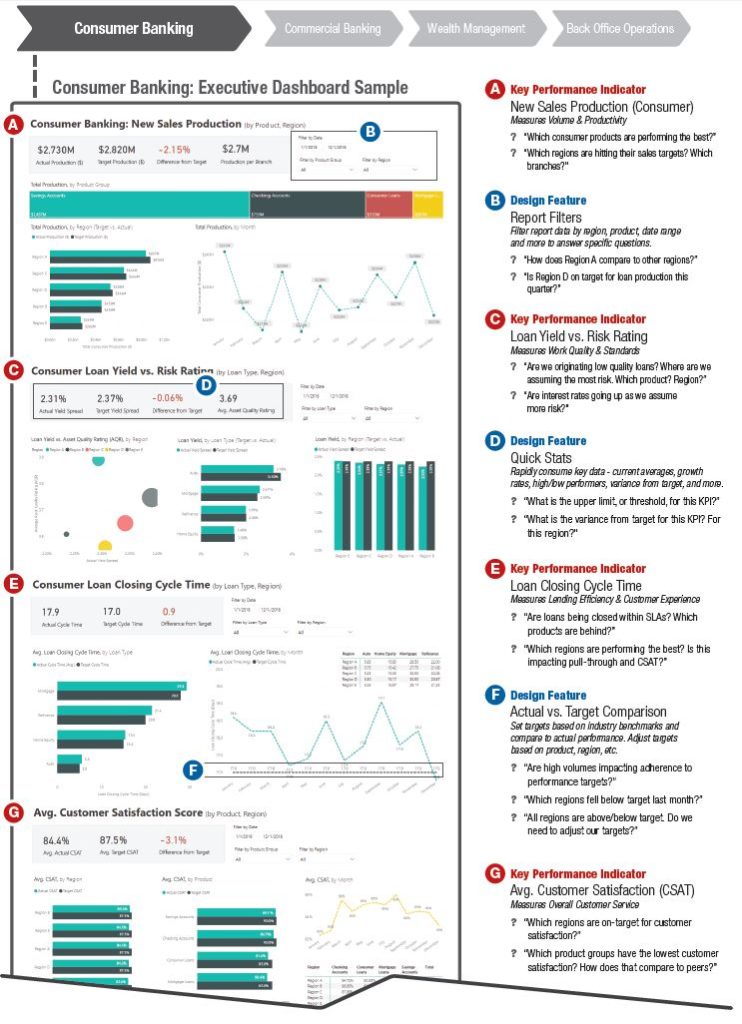

Analytics dashboards and data visualization in banking

Analytics in banking goes far beyond the initial data roundup. Arguably the biggest output of banking analytics is the dashboards that it creates. Working from cleaned-up data, the banking analytics setup creates visualized reporting (dashboards) that’s continuously refreshed behind the scenes. This makes it easy to see, quite literally, the areas where the bank must focus its improvement efforts and up-to-the-minute.

[wants a screen shot/illo of a banking dashboard here]

At the same time, the new data standards behind the dashboards will help your bank to focus on standardizing data on an ongoing basis. This is one of the less obvious benefits of analytics in banking. Your analytics project will almost certainly pay dividends well into the future by fostering a standardized work process.

And in an increasingly mobile world, the ability to access and read dashboards on the go (compared to old-school spreadsheets and graphs) adds yet another benefit to analytics in banking. User-friendly, interactive dashboards not only provide the data needed; they also look good while presenting it.

The importance of KPI selection in banking analytics

We’ve discussed the importance of KPIs, key performance indicators, to implementing analytics in banking; without them, you can’t measure your business in a quantitative way. But KPIs must be curated. You must choose the ones that work best for your goals in business intelligence in banking—in this case, increased productivity.

In their attempts to implement analytics in banking, most businesses will exhibit a tendency to scour every single bit of data available in the company—before considering just what they want to measure. This is a backward approach. You must understand what exactly it is you need to measure before you try to measure it.

You can only achieve true improvement when you can measure against something. This is where key performance indicators or KPIs come into play. KPIs are quantitative values that measure how well a goal is achieved. They are thus integral to business intelligence in banking, especially when a system is being designed. Appropriate KPIs can be used to help with the corollary task of data-cleaning; the KPIs can dictate which data should get wrangled and cleaned.

For example, a bank could have reams of data concerning how many transactions its branches process in a day, or how many tellers the bank has in total, but that by itself won’t help very much with analytics in banking. Yet by combining the different data points into ratios—in this case, “transactions processed per teller”—the bank now has a solid metric it can use to measure against a goal. What banking business intelligence does then, is take that KPI and others, to help create a solid business plan for future improvements to operations.

Example Banking Analytics KPIs

How, then, do you choose which KPIs to use when implementing analytics in banking? Look for KPIs that will help you measure productivity and reduce waste—meaning work that’s actively improving the business. Examples of KPIs that could prove useful for analytics in banking projects include:

- Cost per teller transaction. This KPI is calculated by taking the total teller-related cost of completed transactions, divided by how many transactions are completed by tellers at bank locations over a period of time. A high number here could point to productivity issues concerning too many errors in manual processes, inefficiencies in transaction procedures, and more.

- Teller transaction cycle time. This refers to average time, in seconds, it takes for a customer to complete a transaction with a teller, from beginning to end. Long or inconsistent times may reflect productivity issues such as ineffective technology, training programs, or lack of on-site aids.

- Total deposits per branch. This is the total amount, in dollars, of deposits managed by a bank, divided by the number of retail banking locations managed by said bank. Productivity issues that could lead to a low number here include inefficiencies in account-management processes and untargeted marketing and ad campaigns.

These are but a few of the KPIs you’ll want to consider as you use business intelligence in banking to increase your productivity at the retail branch level.

A case study in retail banking analytics

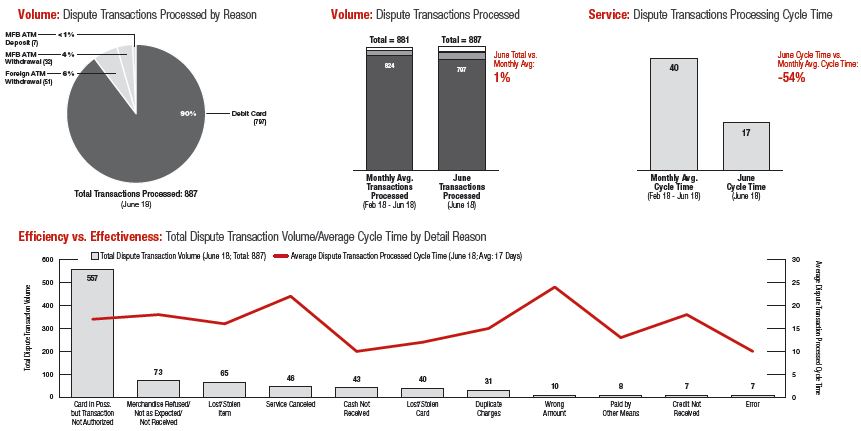

To undertake its banking analytics project, this top-50 U.S. bank needed, among other things, an assessment of its existing data, as well as development of interactive dashboards to better serve and display their actual business intelligence.

The project required digging into the bank’s data and identifying the KPIs that were most valuable for implementing business intelligence in banking. Using its business-intelligence partner’s cloud-based Power BI services, this bank was able to develop multiple dashboards that expressed, clearly and definitively, data for the bank’s sales, loan processing, and customer-service organizations.

All dashboards were published throughout the entire organization and easily accessible by management by logging onto an external site. No new technology implementation was required.

The importance of clean banking data for analytics

With upstart competitors such as Amazon dipping their toes into the banking pool, it’s more important than ever for banks to take advantage banking analytics.

This means leveraging data. Banks do, currently, possess a lot of data, across a diversity of sources and systems, from ATMs to traditional credit-processing functions of the business. But while banks generally have a great quantity of data, its quality is often insufficient for business intelligence to work. This “landfill” of data—low quality, messy, and improperly formatted—requires cleanup first.

Indeed, 80 percent of analytics project time is usually dedicated to cleaning and formatting data. If it’s not meta-tagged in any useful way, the data must be “hand cleaned” to be useable for analytics in banking. The situation is exacerbated by the fact that most banks lack the kind of trained staff needed who can do this kind of work. That’s not a shortcoming of the banks per se; it’s simply a reality of today’s banking industry: it’s not configured to set up analytics and business intelligence systems.

Well-managed banking data can continue to pay dividends long after a banking analytics project has begun. A single project can help to pinpoint possibilities for cost reductions and operational improvements. New KPIs can always be added for future projects, based on available data.

And analytics in banking provides real-time information, allowing for continual monitoring of progress toward defined KPI goals.

How to configure a banking data repository

In order to take advantage of the powerful reporting and dashboards of business intelligence and analytics in banking, it’s essential to first create a single data repository. This can be created online, using a unique login that can be shared with appropriate team members, and configured to control access as far as who-gets-to-see-what.

Once the data repository is properly established and configured, it’s relatively easy to generate automated reports. Importantly, whatever anyone views is now coherent, because it’s all based on an analysis of the same synchronized data.

How banking analytics helps with process standardization

Analytics in banking helps with more than data; it also spotlights opportunities for standardizing work activities. That’s because it makes inconsistencies easier to recognize.

Opportunities for process standardization can take different forms: they can include everything from entire core business-unit processes to standardizing forms at the front-line level.