We see it all too often. Banks struggle with—“drown in”?—messy data. They struggle to deal with it. So, they throw Excel sheet after Excel sheet at the problem. Why? They want to report as much as they can. And they miss the importance of business intelligence in banking.

Does this help? Does it solve the problem?

Of course it doesn’t! You knew that. But it still happens. It leads to long hours. High costs. Lots of people working on lots of reports—all of questionable value.

How, then, do you solve this problem? That’s the topic of this blog!

How to cut costs with business intelligence in banking

One of the main benefits of business intelligence in banking comes in the form of dashboards. Clear, clean, beautiful, and efficient dashboards. Properly implemented, these can help you pull in data from multiple platforms. And you can see the results all from one spot—like that chair you’re sitting in right now.

Here’s how we tackle projects like this at OpsDog. When we work on business intelligence in banking, we’ll create a single repository. Our clients (read: “You”) access it online, using a unique log-in that you can share with appropriate team members. In fact, it’s easy to configure who-gets-to-see-what. But the important thing is, whatever you’re allowed to see, it’s all coherent. It all matches. It all matters. That’s because it’s all based on an analysis of the same good, clean data! It is—drum roll, please—The Truth.

Once you have this, you’re set. It’s then relatively easy to generate automated reports. They’re fast. They’re gorgeous. They’re accurate. And they’re useful, too. That’s one of the biggest benefits of business intelligence in banking.

Process standardization via business intelligence in banking

Data is not the only thing we streamline. Oh, no. Business intelligence in banking requires more than that. When working on a KPI-driven project, we’ll often find that banks can miss key opportunities for standardizing work. In a word, ouch.

But the importance of business intelligence in banking comes to the rescue. It lets you turn a fresh eye toward the problem. It makes the inconsistencies easier to spot.

How, then, do you take advantage of the benefits of business intelligence in banking? Look at the data. It will shine the light on opportunities for process standardization. These can take different forms. But you need to look at, and measure, the right things. You can’t harness the power of business intelligence in banking without KPIs that matter to the business overall. In other words, you need to cast the proper net.

We recently worked with a major bank on a business intelligence in banking project just like that. Our team got a look at their data. We measured it against the vital KPIs. And sure enough, we found opportunities for them to improve operations via process and data standardization. This included everything from entire core business-unit processes to standardizing forms at the front-line level.

The results were powerful. And the importance of business intelligence in banking resonated throughout the enterprise.

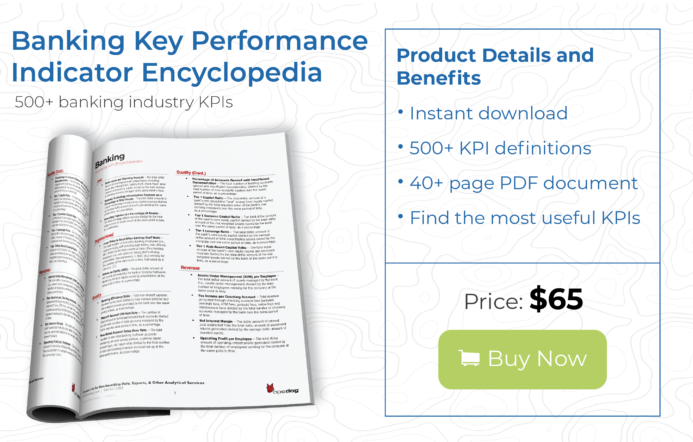

Business intelligence in banking can open a lot of doors for improvement. Let OpsDog help. Check out our banking-specific KPIs, ready for inexpensive purchase and instant download. Or learn about our custom services. Contact us today to get started.