What are Mortgage Lending KPIs?

Mortgage lending KPIs and metrics measure the effectiveness and efficiency of the loan process – from sales through closing, and beyond. The mortgage origination process has several distinct steps where KPIs can be implemented – sales, application processing, underwriting, close/post-close and funding. After a mortgage has been closed, the lender either retains the loan for servicing (and securitization), or sells it to another financial institution – KPIs can also be measured within these processes to track service levels and/or loan profitability.

Using KPIs and Metrics to Manage and Improve Mortgage Operations

Measuring the efficiency of the loan process – and the quality of loans being originated by the institution – is critical for both sales growth and compliance. Take loan officers as an example. An effective manager must be able to understand where each officer stands in terms of actual versus targeted production. And beyond that, they must understand the risk profile (typically expressed as a risk score, or rating, for each loan) and interest rate spreads for each loan officer to ensure they aren’t sacrificing quality for production volume.

Mortgage KPIs: The Top 5 Metrics for Managing Mortgage Operations

Originating and servicing mortgage loans is a highly transactional business, lending itself to systematic KPI measurement and management. Digging down into detail on each mortgage sub-process is worthwhile, but there are also some top line metrics that executives and managers should always be aware of – here are the top 5:

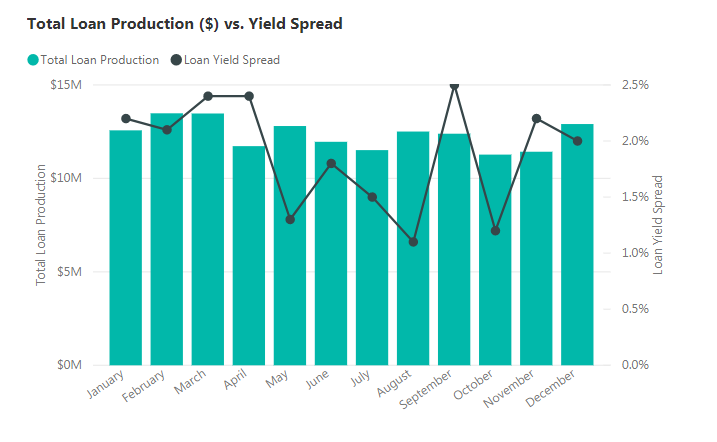

- 1.Total Loan Production ($)

- 2.Loan Yield Spread

- 3.Mortgage Closing Cycle Time

- 4.Unit Cost: Loan Origination

- 5.Mortgage Application Pull-Through Rate

Buy Mortgage Lending KPI Benchmarking “Data-as-a-Service” Products from Opsdog

Opsdog.com sells Mortgage Lending KPI and benchmarking data in three different ways.

- Comprehensive Mortgage Lending KPI benchmarking reports bundles that include 10 to 80+ measured KPIs.

- Price range is from $750-$2000 per report

- Instant download

-

Individual Mortgage Lending KPI benchmarks that contain 1 benchmarked KPI –

- Price range is $50-$65 per individual benchmarked KPI

- Instant download

-

Custom Mortgage Lending benchmarking KPI Data-as-a-Service projects and consulting engagements

- 3-10 week long KPI benchmarking projects

- Price varies based on scope

- Hybrid on-site/off-site low-cost model

Browse Instant Download Mortgage Lending KPI and Benchmarking Products for Purchase Below

Blow away your boss with business intelligence KPI dashboards!

Pounce on the power of business intelligence with our custom KPI dashboards.

Let us help you master the art of business intelligence and KPIs

Select an industry.

-

Support Group Operations

-- 344Finance

- 245Human Resources

- 230Information Technology

- 372Marketing

- 70Legal

- 93Compliance

- 165Shared Services

- 16Risk Management

-

General Line Groups

-- 150Call Center

- 150Customer Service

- 162Product Development

- 102Collections

- 300Sales

-

Supply Chain Operations

- -

Financial Services

-- 966Banking

- 229Insurance

- 130Mortgage Lending

- 428Investment Management

- 445Broker Dealer

- 235Consumer Finance

-

Healthcare

- -

Other Services

-- 118Utilities

- 65Print Publishing

- 68Broadcast Media

- 263Advertising

- 90Retail

Let us take your KPIs & business intelligence efforts to the top.