What are Consumer Finance KPIs?

Consumer finance KPIs measure productivity, quality, customer service, risk and cost related to the major products provided by a typical consumer finance company, or function: mortgage loans, auto loans, credit cards and payment services (e.g., peer-to-peer payments, etc.). KPI measurement for consumer finance should focus on high volume processes, such as loan origination (sales, processing, close), underwriting, loan servicing, customer on-boarding, and transaction processing.

Using KPIs to Measure Consumer Lending and Credit Card Operations

Customers working with consumer finance companies typically have many options (i.e., competitors) to choose from. Developing competitive products, improving digital channel experience and adoption, and offering best-in-class customer service are key market differentiators. KPIs should be defined and implemented to measure the performance of each of those mission critical objectives. For example, loan performance KPIs (e.g., production, pull-through, cycle times, CSAT, etc.) should be analyzed separately for traditional and digital channels to inform marketing, sales and product development.

Consumer Finance KPIs: the Top 8 Metrics to Start With

There is no shortage of data for consumer finance companies to incorporate into their business intelligence programs – even more so for those with highly digitized operations. At a high-level, KPIs should focus on product performance and customer experience. Here are 8 KPIs that most consumer finance companies measure:

- 1.Loan Yield

- 2.Loans Outstanding

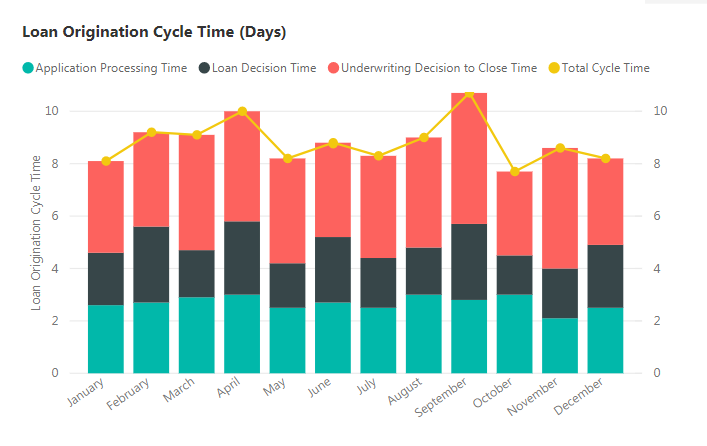

- 3.Loan Origination Cycle Time

- 4.Application Pull-Through Rate (by Product)

- 5.Credit Card Account Attrition

- 6.Percentage of Accounts Past Due (30, 60, 90 Days)

- 7.Percentage of Households with Multiple Products

- 8.Average Customer Satisfaction Score

Buy Consumer Finance KPI Benchmarking “Data-as-a-Service” Products from Opsdog

Opsdog.com sells Consumer Finance KPI and benchmarking data in three different ways.

- Comprehensive Consumer Finance KPI benchmarking reports bundles that include 10 to 80+ measured KPIs.

- Price range is from $750-$2000 per report

- Instant download

-

Individual Consumer Finance KPI benchmarks that contain 1 benchmarked KPI –

- Price range is $50-$65 per individual benchmarked KPI

- Instant download

-

Custom Consumer Finance benchmarking KPI Data-as-a-Service projects and consulting engagements

- 3-10 week long KPI benchmarking projects

- Price varies based on scope

- Hybrid on-site/off-site low-cost model

Browse Instant Download Consumer Finance KPI and Benchmarking Products for Purchase Below

Win the business-intelligence dogfight with custom KPIs and dashboards from OpsDog

If business intelligence is your pet project, empower it with custom dashboards from OpsDog.

If KPIs without the business intelligence is your pet peeve, contact OpsDog for a custom dashboard demo

Select an industry.

-

Support Group Operations

-- 344Finance

- 245Human Resources

- 230Information Technology

- 372Marketing

- 70Legal

- 93Compliance

- 165Shared Services

- 16Risk Management

-

General Line Groups

-- 150Call Center

- 150Customer Service

- 162Product Development

- 102Collections

- 300Sales

-

Supply Chain Operations

- -

Financial Services

-- 966Banking

- 229Insurance

- 130Mortgage Lending

- 428Investment Management

- 445Broker Dealer

- 235Consumer Finance

-

Healthcare

- -

Other Services

-- 118Utilities

- 65Print Publishing

- 68Broadcast Media

- 263Advertising

- 90Retail

Let us take your KPIs & business intelligence efforts to the top.